BNP Paribas

Inventing Tomorrow's Bank Through Innovation

Powering up a dedicated in-house innovation and acceleration center

Inventing tomorrow's bank

BNP Paribas is the leading bank in the European Union, with more than 7 million customers in France. In order to maintain its leading position and retain its image as a progressive bank, BNP Paribas needs to be at the forefront of innovation and consistently offer new services to its customers. It was with this in mind that BNP Paribas created DITA: an entity specifically dedicated to innovation and acceleration within the organization’s commercial and personal banking arm, Banque Commerciale en France (BCEF). DITA represents a new approach, with a dedicated compact team comprising of senior team members.

Since 2021, frog, part of Capgemini Invent, has partnered with BNP Paribas to support and challenge DITA, ensuring it stays effective. The partnership has encompassed three types of project. First, exploring reports on new trends and how the evolution of technology can be relevant to DITA’s output. Second, deploying strategic innovation sprints which, in 10 weeks, validate concrete strategies for future implementation. Third, activating acceleration projects which, once a focus has been defined, enable the bank to refine, develop and implement these changes.

Using partners like frog and Capgemini helps us to be robust in the face of unforeseen acceleration events

Three avenues of exploration

Project highlights

New face of work

Exploring the gig economy

New forms of work contracts have emerged, such as "task-based" contracts, facilitated in particular by platforms like Uber or Deliveroo. The BNP Paribas innovation team wanted to better understand this target clientele to be able to imagine the new products or services it could develop for this type of worker. To get to know this growing trend, the two teams from DITA and frog created a series of personas and analyzed the factors driving the emergence of this trend. This process also included interviews with Uber employees, and the study of competitors from BNP Paribas and other brands. Together, these studies provided a picture of the potential impact of the gig economy, and were followed up by a sprint to develop a relevant strategy.

Streamlining services

Elevating the use of bots

Chatbots are everywhere, present on virtually every site. BNP Paribas already had its own chat solution, but wanted to improve its performance. They wanted a clear strategy and a new solution, in line with the customer journey and qualitative user experience it was keen to offer. The timing was right for this, as it coincided with the emergence of technologies such as ChatGPT, whose potential in this area is immense. Stakeholders built a nine-week sprint program and imagined several scenarios; eight of these potential ideas were further analyzed: their viability, desirability and feasibility. Finally, prototypes were co-constructed by all stakeholders, providing BNP Paribas with a complete strategy and a set of potential options.

User perks

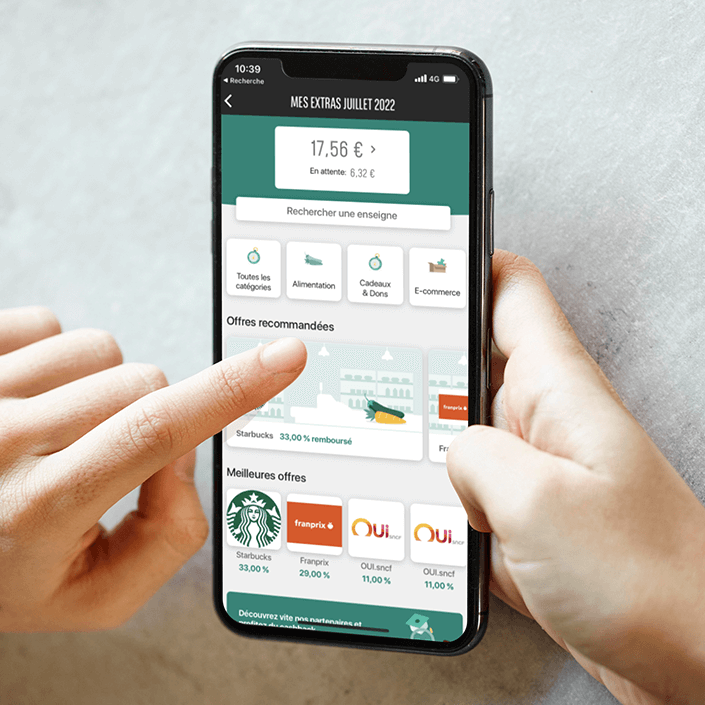

Launching a cashback program

In a competitive context where banking and non-banking players are launching their own cashback programs, BNP Paribas wanted to develop its own program, with the aim of attracting and retaining its customers as well as providing them with added value, enabling them to micro-save and treat themselves. The DITA innovation team and frog defined a strategy for the program, designed the customer journeys, built the MVP and tested the solution with BNP Paribas employees. In just 10 months, the Mes Extras program was launched on the market, and now offers automatic discounts from privileged partners to over 280,000 customers.

Thanks to its DITA team—and its dedication to innovation and acceleration and the various projects carried out in collaboration with frog—BNP Paribas is in a position to imagine and deploy new products and services for its customers. The collaboration continues to support the realization of creative solutions in a highly competitive sector, which in turn is helping to build the foundations of tomorrow's bank.